-

By Mike Steele

-

October 3, 2018

- 0 Comment

3 Critical Lumber Mill Financial Drivers: Why Your Ladder May Be Against the Wrong Tree

To a passerby, a ladder leaning against a tree conveys a message. It tells them that the owner of the ladder has determined that, among all the trees in the forest, he has chosen to ascend this one. It indicates intent. It reflects focus.

But what if it’s the wrong tree? What if, while working through a stand of trees with a ladder, the ladder owner simply chose the tree he felt he could climb most easily, reach the highest, harvest the most fruit from, or that best matched his boss’s description?

One thing is certain: without a clear goal, the ladder owner will eventually choose a tree and put all his effort into climbing it, whether it’s the right choice or not.

Managers, supervisors, and employees are no different. They come to work every day and are asked to pour their energy, attention, and problem-solving skills (their ladders) on the thing that the company has determined is most important (the tree). Having spent a lot of time in lumber mills over the years, I can pretty easily determine what is most important to an organization by talking to a supervisor. The conversation goes something like this:

“Hey Wayne, how did your shift go today?”

“Pretty good. We had some downtime at the edger that started backing up the mill, so I turned off the sideboards at the primary breakdown. We were able to surpass our goal of 40,000 BF per hour!”

Wayne’s ladder is placed firmly against the Production tree. And he’s not alone. Talk to supervisors, operators, or mill managers in most lumber mills, and you’re likely to hear a similar refrain. While other things are important, production is king.

But should it be?

To answer that question requires recognizing the key financial drivers in lumber mills. These include production, fiber recovery, and lumber value. It also requires an understanding of how improvements to each of those drivers impact bottom line profitability.

The Value of a 1% Improvement

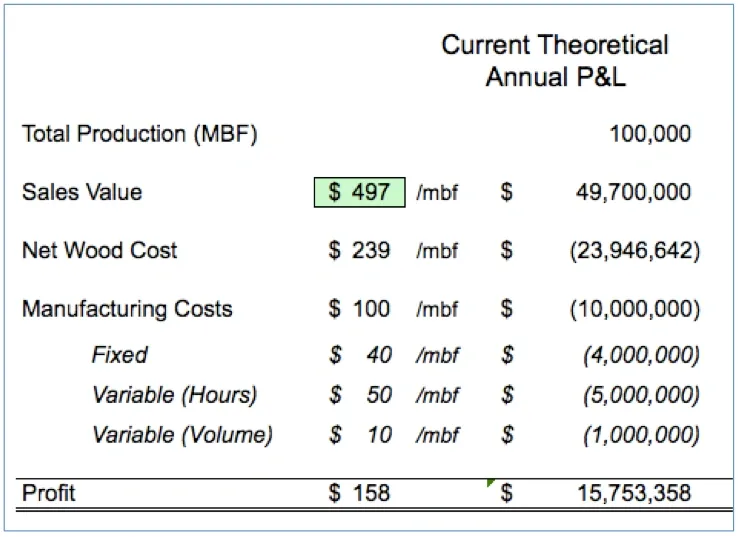

Consider the table below reflecting a “Current Theoretical Annual P&L” for a lumber mill producing 100,000 MBF based on an average lumber sales price of $497/MBF (the 2018 average as reported by RandomLengths.com). This P&L makes assumptions on net wood cost and has broken out manufacturing costs into the categories of fixed, variable by hour, and variable by volume.

Obviously, in this amazing lumber market, profit margins are incredibly high ($158/MBF in this example), so the mill should want to produce as many MBF as possible. But the question is, how does the benefit of a production gain compare to a similar gain in recovery or value?

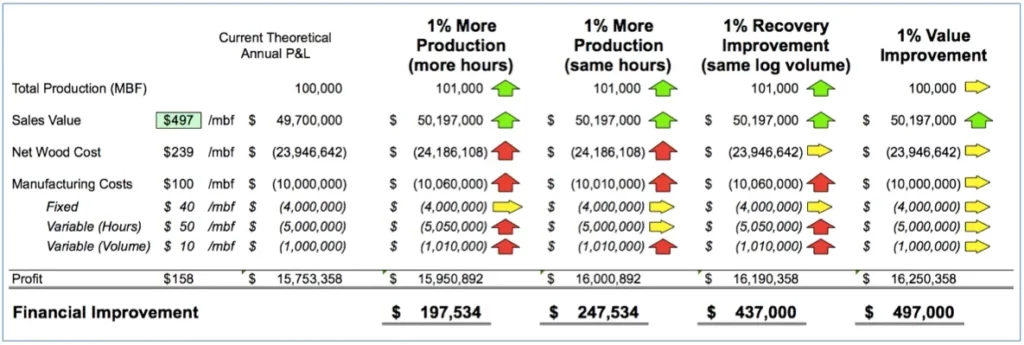

Below is a table that answers that question by expanding the current P&L to a series of scenarios that each reflect a 1% change to a financial driver.

- A 1% increase to production by increasing hours nets a total of $197,534 per year.

- A 1% boost in production via improved efficiency with no additional hours is worth $247,534 per year (24% more than simply running more hours).

- A 1% increase in lumber recovery that generates more lumber with the same log volume is worth $437,000 per year (1.8 – 2.2 times more than a production gain).

- A 1% higher lumber value due to a lumber mix improvement, or better grade out, is worth $497,000. (2 – 2.5 times more than a production gain, and 14% more than a recovery gain).

From these numbers, we can see that in the best lumber markets, production is important, but recovery and value are critical.

Supervisor Wayne’s decision to turn off sideboards (a major hit to recovery) to meet a production target can now be viewed with the skeptical eye that it deserves.

If you’ve spent any time in this industry you’ll know that the only thing with more ups and downs is a roller coaster. So what happens when lumber prices fall back out of the stratosphere? We don’t have to go back to the time of the housing crisis to see massive swings in lumber pricing. We can just look back at the last five years.

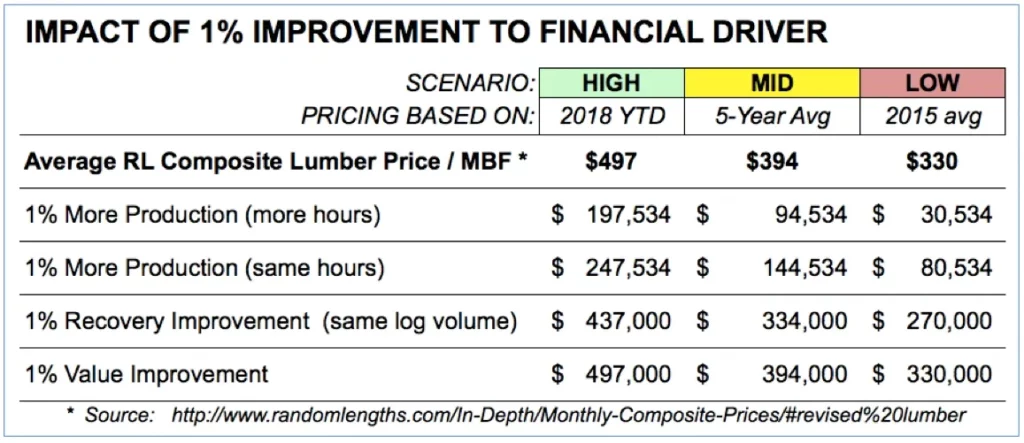

The table below answers the question of what 1% is worth to a mill under three different pricing scenarios:

- High Lumber Pricing ($497/MBF – using 2018 YTD average pricing)

- Mid Lumber Pricing ($394/MBF – using a 5 year average (2014-2018))

- Low Lumber Pricing ($330/MBF – using average pricing from 2015)

As you can see from the table, all impacts drop, but the hit to production is nearly catastrophic as profit margins flatline. By contrast, the multiple on a 1% improvement to recovery and value skyrockets.

So where do I put my ladder?

It’s a trick question. The truth is, there is more than one tree, and you need more than one ladder.

Like the old “walking and chewing gum” analogy, recognize that your organization can, and must, do more than one thing well. It can drive maximum operational and financial performance, but only by placing appropriate and balanced importance on all financial drivers.

If your daily management meetings consist of supervisors reading recovery numbers, percentage metrics (‘% wides’ or ‘% 2 and better’), and lengthy discussions about production metrics and downtime, then you’re running a one-tree, one-ladder business.

Some companies are using today’s high lumber prices as an excuse for a temporary excessive focus on production. They don’t realize that such an approach is harming their team and their business by building what the Marine Corps calls “training scars”. Marines recognize that you fight like you train. If you baby your training, set easy standards, or avoid accountability, then when challenges arise, you and your team won’t be prepared to respond—and there will be unnecessary casualties.

In the lumber business, the mills that flourish during the tough times and don’t become casualties are those that lack “training scars”. They’re the ones that maintain a consistent, disciplined and appropriate focus on all financial drivers, irrespective of the lumber market. Long term winners are those that don’t have their team on a single ladder leaned against the wrong tree.

If your organization doesn’t have the proper balance in the management of your mills, now is the time to inject the proper focus, structure and discipline. Don’t wait until the lumber market roller coaster starts its inevitable downward journey.

We can help you identify and capture the millions of dollars a year that can be lost in each mill through sub-optimal execution. Just reach out!